Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

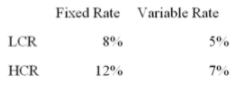

Assume that two firms, one considered a high credit risk (HCR) and the other a low credit risk (LCR), are considering an interest rate swap. Each can borrow at the following rates:

An interest rate swap would be beneficial to both parties if:

A. the LCR firm wants to borrow at the fixed rate and the HCR firm wants to borrow at the variable rate.

B. the HCR firm wants to borrow at the fixed rate and the LCR firm wants to borrow at the variable rate.

C. both firms want to borrow at the variable rate.

D. both firms want to borrow at the fixed rate.

E. an interest rate swap would be never beneficial in this situation.

Answer

This answer is hidden. It contains 1 characters.

Related questions

Q:

Which of the following adjustments are made to gross loans and leases to obtain net loans and leases?

A. Loan and lease loss allowance is added to gross loans.

B. Unearned income is subtracted from gross interest received.

C. Investment income is added to gross interest received.

D. Loan and lease loss allowance and unearned income is subtracted from gross loans.

E. Loan and lease loss allowance is subtracted from gross loans and investment income is added to gross interest received.

Q:

Financial statements issued by banks and by nonbank financial-service firms look increasingly similar today.

Q:

Net loans on a bank's balance sheet are derived by deducting the allowance for loan losses and unearned discounts from gross loans.

Q:

Securities income is a financial output listed on a financial institution's Report of Condition.

Q:

__________ consists of interest income received on loans from customers that has not yet been earned by the bank under accrual accounting methods.

Q:

______________ is labeled "Accounting for Derivative Instruments and Hedging Activities".

Q:

_____________________ is the sum of all outstanding IOUs owed to the bank in the form of consumer, real estate, commercial, and agriculture loans as well as other types of credit extensions.

Q:

The short-term securities of the bank, including T-Bills and commercial paper, are often called __________________________ because they are the second line of defense to meet demands for cash.

Q:

In-store services usually require:

A. more capital than other banks.

B. more aggressive marketing plans than other banks.

C. more employees than other banks.

D. more advanced technology than other banks.

E. All the options are correct.

Q:

Following charter approval, a bank's stock can be legally offered to the public through a(n) ___________________ that describes the charter's business plan and terms of sale.

A. offering memorandum

B. offering article

C. underwriter's commitment report

D. merchant banker's report

E. None of the options are correct

Q:

A minimum of ___________ persons are required as organizers to apply for a federal bank charter.

A. two

B. three

C. five

D. seven

E. ten

Q:

The Jones State Bank is planning to add a branch office on the west side of Edmond, Oklahoma. The bank has done a survey of local residents near the area where it wants to build the branch office and has discovered that most residents are in their 50's and 60's. Which factor would this address when considering whether to add a new branch?

A. Traffic count

B. Number of retail shops

C. Average age of the local population

D. Population Density

E. Population Growth

Q:

Which of the following would not be a telephone service that customers can get from a bank call center?

A. The current balance in their account

B. A fax copy of a loan application to the bank

C. List of what transactions have passed through the account

D. Access to their safety deposit box

E. All the options are telephone services customers can get from a bank call center

Q:

A(n) _________________________ is the fee a buyer must pay to be able to put securities to, or to call securities away from the option writer.

Q:

A(n) _________________________ is an agreement between a buyer and a seller today which calls for the delivery of a particular security in exchange for cash at some future date for a set price.

Q:

Maryellen Epplin notices that a particular T-Bill has a banker's discount rate of 9 percent in the Wall Street Journal. She knows that this T-Bill has 20 days to maturity and has a face value of $10,000.

What is the yield to maturity on this T-Bill?

A. 9 percent

B. 0.5 percent

C. 4.5 percent

D. 9.17 percent

E. None of the options is correct.

Q:

If interest rates on both assets and liabilities decrease by 2 percent in the next 90 days, what should happen to this bank's net interest margin?

A. It should fall by 2 percent.

B. It should fall by 0.6 percent.

C. It should fall by 4 percent.

D. It should fall by 1 percent.

E. It should not show any fall.

Q:

Which of the following would be an example of a repriceable asset?

A. Money the bank has borrowed from the money market

B. Cash in the vault

C. Demand deposits that do not pay interest

D. Short-term securities issued by the government about to mature

E. All of the options are correct.

Q:

A bank is liability sensitive, if its:

A. deposits and non-deposit borrowings are not affected by changes in interest rates.

B. interest-sensitive assets exceed its interest-sensitive liabilities.

C. interest-sensitive liabilities exceed its interest-sensitive assets.

D. loans and securities are affected by changes in interest rates.

E. None of the options is correct.

Q:

The _______________ is determined by the demand and supply for loanable funds in the market.

A. coupon rate

B. reserve requirement

C. interest-sensitive gap

D. risk-free real rate of interest

E. duration gap

Q:

A bond has a face value of $1,000 and five years to maturity. This bond has a coupon rate of 13 percent and is selling in the market today for $902. Coupon payments are made annually on this bond. What is the yield to maturity (YTM) for this bond?

A. 13 percent

B. 12.75 percent

C. 16 percent

D. 11.45 percent

E. 12 percent

Q:

A bank has Federal Funds totaling $25 million with an interest-rate sensitivity weight of 1.0. This bank also has loans of $105 million and investments of $65 million with interest rate sensitivity weights of 1.40 and 1.15 respectively. It also has $135 million in interest-bearing deposits with an interest rate sensitivity weight of 0.90 and other money market borrowings of $75 million with an interest rate sensitivity weight of 1.0. What is the dollar interest-sensitive gap for this bank?

A. $50.25 million

B. -$15 million

C. -$50.25 million

D. $34.25 million

E. None of the options is correct.

Q:

Suppose Bank A's stock price is $75 and Bank B's stock price is $25. Bank A is planning to purchase Bank B by paying Bank B's shareholders a bonus of $10 per share. If Bank B has 100,000 shares outstanding, how many shares of Bank A will the shareholders of Bank B receive?

A. 100,000 shares

B. 33,333 shares

C. 46,667 shares

D. 214,286 shares

E. None of the options is correct

Q:

There are three banks in East Panhandle. First National Bank which currently has 40 percent of the deposits in the area, Second State Bank which currently has 30 percent of the deposits, and New State Bank and Trust which also has 30 percent of the deposits. What is the Herfindahl-Hirschman Index for East Panhandle?

A. 100

B. 1,200

C. 3,400

D. 2,400

E. None of the options is correct

Q:

_________________ is a danger faced by the stockholders of an acquiring firm in a merger if excessive numbers of new shares are issued relative to the value of their old shares.

A. Earnings volatility

B. Reduction of the exchange ratio

C. Dilution of ownership

D. Increased risk of bankruptcy

E. None of the options is correct

Q:

According to the textbook, the lackadaisical profit performance surrounding a merger may be explained by the:

A. tax inefficiencies due to a merger.

B. lenders cutting off credit lines due to the merger.

C. accounting irregularities when reporting earnings of the combined entity.

D. managerial hubris and sizeable merger premium that acquirers have to pay to shareholders of the acquired firms.

E. All of the options are correct.

Q:

According to the textbook, bank mergers are often motivated by:

A. profit potential.

B. expected reduction in the risk of fluctuations in cash flow and earnings.

C. expected tax benefits.

D. market-positioning strategies.

E. All of the options are correct.

Q:

According to FASB, goodwill must now be amortized over its useful life.

Q:

The most important goal of any merger should be to increase the market value of the surviving firm.

Q:

The merger of Bank of America and Security Pacific in 1992 resulted in an expansion of branch offices for both banks.